Ask any Mission Viejo real estate agent and they will tell you buying and selling a home at the same time requires careful planning. The Mission Viejo real estate agents at Inspired Realty offer these tips for buying and selling a home at the same time.

Before getting to know a Mission Viejo real estate agent, get to know your finances

Financial Preparation

Before listing your existing home or shopping for a new home, it pays to get your financial house in order. This includes understanding your budget, planning for expenses and cash flow, and creating a financial backup plan.

Get Pre-Qualified: Get pre-approved for a new mortgage before listing your current home to understand your buying power and set a realistic budget.

Assess finances: Analyze your cash flow and estimate potential temporary housing costs to ensure you can manage the transition period. What will you do if your home sells immediately?

Explore Bridge Loans: Will you need a bridge loan to cover the down payment and closing costs on the new home if the sale of your existing home doesn’t close first? This option may reduce the stress of simultaneous transactions, but it usually comes with a high interest rate.

Selecting a Mission Viejo Real Estate Agent and Strategy

Pulling off the sale of an existing home while purchasing a new home requires the services of a skilled agent. You need expertise in timing transactions and insights into the average length of the process. Having a seasoned Mission Viejo real estate agent like the ones at Inspired Realty helps.

Agent Experienced in Simultaneous Transactions: These situations present unique challenges. Be sure to select an agent with expertise in simultaneous transactions to guide you through the process. When interviewing potential agents, ask not only about their experience listing and selling Mission Viejo homes but also how often they handle buying a Mission Viejo home at the same time.

Get a Market Analysis: Your Mission Viejo real estate agent must accurately price your current home to sell quickly and develop a strategy for your new home purchase. Having a buyer’s and seller’s market analysis is crucial.

Understand Contingency Clauses: Your agent and strategy should be ready to include contingencies in your offer on the new home, making the purchase dependent on the sale of your current property. Not all sellers are willing to accept contingency clauses. A skilled agent advocates on your behalf.

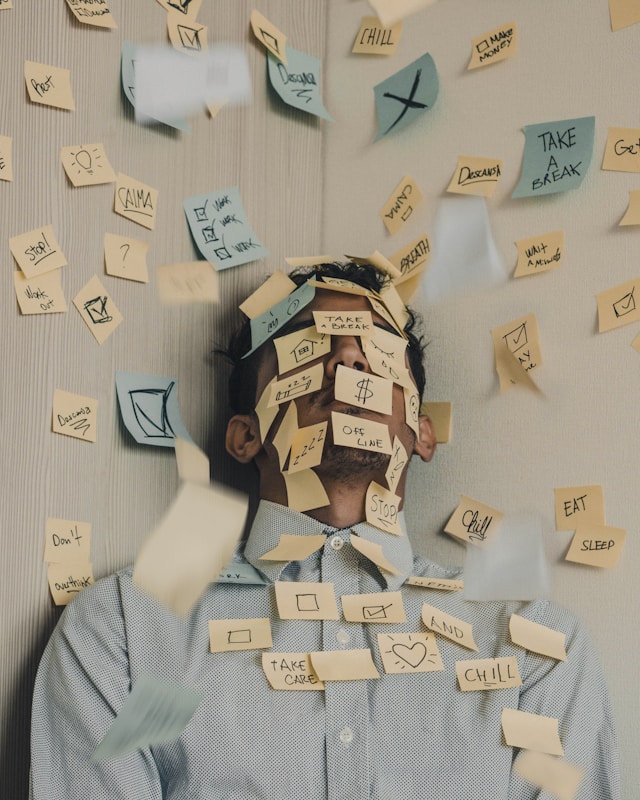

The Right Mission Viejo Real Estate Agent Prevents This Feeling

Coordinate Logistics and Timing

In an ideal situation, you would close on your old home and your new home on the same day at the same time. Forget that fantasy. Prepare for the reality of one home selling and closing before the other.

Temporary housing: Arrange temporary living arrangements like staying with family, the short-term rental of an apartment, or holing up in a hotel or an Airbnb if necessary.

Rent-back agreement: Consider a rent-back agreement if you need to stay in your current home for a short period after closing. Ask your Mission Viejo real estate agent if they are experienced in these negotiations.

Closing date coordination: Rely on your agent to coordinate closing dates on both properties to minimize the time between selling your old home and buying the new one. An agent with experience in Mission Viejo knows the approximate amount of time it takes to close either of those transactions once you have a signed contract.

Communication: Maintain open communication with your real estate agent, lender, and all parties involved to keep the process moving smoothly.

Mission Viejo Real Estate Agent and Contractor

Whether you need to make repairs to your existing home or update the home you are buying, be ready to prioritize the work.

Inspired Remodels, the sister company of Inspired Realty repairs and remodels homes in Mission Viejo and throughout Orange County. Rely on this dynamic duo to get your existing home ready to sell and make your new home the home of your dreams.

TLDR: When buying and selling a home simultaneously, key tips include:

getting pre-approved for a mortgage, considering a bridge loan, choosing a skilled real estate agent, securing temporary housing, and carefully coordinating closing dates to minimize disruption and potential financial risks.